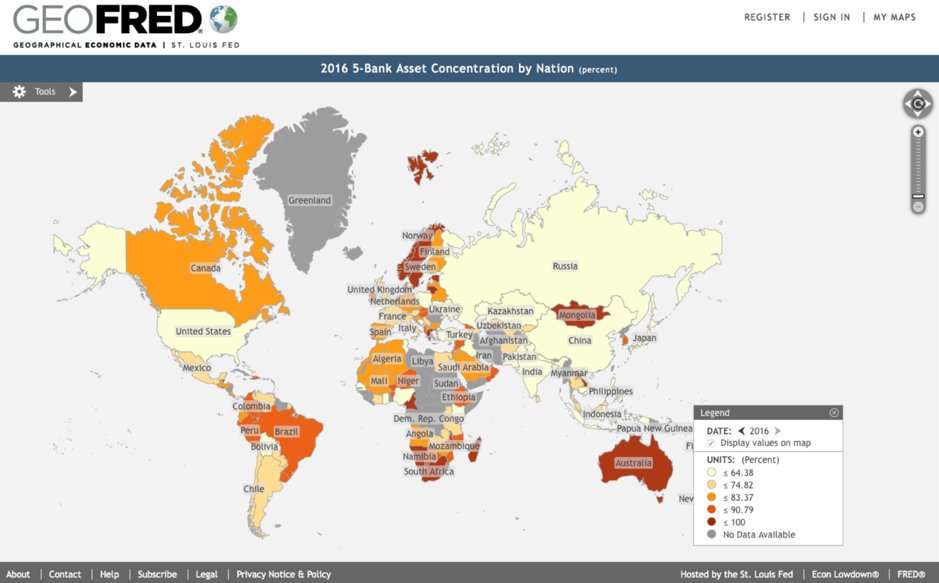

World’s local bank – is there such a thing? It would seem not, or so suggests the data. Foreign banks share of banking sector assets is abysmally low especially so for large emerging market countries. Growth of emerging economies, that have deeper roots and larger credit appetites, are typically supported by domestic banks. According to a report published by the New York Fed in 2014, which focuses primarily on US exports, while US banks provide trade finance to most countries, the business is highly concentrated with 90% of the market being covered by the top 5 banks (see chart). Empirically, in the top 7 GDPs in the world, International Banks are immaterial to the real GDP of the country outside their own. Let’s take the case of China, India, Germany, Japan, France and all are largely supported by the local banks that have become regional/international.

Read more on this in our whitepaper.