Usance credit payable at sight is a structure where the Letter of Credit issued by Importer’s bank is a Usance LC and contains clauses that allow the exporter to get paid immediately through a financing bank while the importer pays after the end of the usance period, thus availing credit period. Under the UPAS structure, associated expenses including draft acceptance charge, discounting interest and service charge are paid by the importer (LC applicant).

Suppliers Credit / LC discounting structure is conceptually similar to UPAS except that in these classic structures, the associated expenses including draft acceptance charge, discounting interest and service charges are paid by the exporter (LC beneficiary).

Avail credit period even if the exporter gets sight payment.

Avail commercial discounts offered for immediate payments.

Use non-fund based lines to avail foreign currency financing with no impact on capital structure.

Get financing from any bank without depending on your working capital bank alone.

Beat competition and increase sales by providing higher credit period to your customer and still get paid at sight.

Avail matched currency financing for financing your exports and manage forex risk better.

Unlock your trapped cash in LC backed receivables and finance your working capital for business.

Reduce your cost of financing.

Letter of Credit (LC) confirmation is a guarantee provided by a second bank for the payment risk of the LC issuing bank. LC confirmation may be required if the exporter is not comfortable with the credit risk or country risk of the LC issuing bank. Sometimes LC confirmation might be required by the LC negotiating bank before negotiating the Letter of Credit or by the LC issuing bank in case the bank risk of the Master LC issuing bank is unacceptable.

Exporters can mitigate the country risk/payment risk of the issuing bank and be assured of the payment by moving the risk to the confirming bank.

Sometimes the discounting cost can be reduced by confirming the LC from a better rated bank.

A Reimbursement Bank is a bank which has been authorised by the issuing bank to provide reimbursement to the exporters bank (claiming bank) by accepting and paying a time draft drawn on the reimbursing bank.

The Reimbursement Authorisation (RA) structure is similar to UPAS/ Supplier’s credit where the importer gets a credit period and exporter gets paid at sight, however the two structures are different when it comes to process and document flow.

While the UPAS structure requires the LC documents to be routed through the financing bank, the RA structure does not require the LC and trade documents to be routed through the reimbursement bank. Instead the acceptance for LC and copies of other documents are sent to reimbursement bank by the issuing bank through Swift network. This gives additional flexibility to get a Reimbursement bank anywhere in the world as original trade documents are not routed through it.

Avail credit period even if the exporter gets sight payment

Avail commercial discounts offered for immediate payments.

Use non-fund based lines to avail foreign currency financing with no impact on capital structure.

Get financing from any bank without depending on your working capital bank alone.

Since original documents are not required to be routed through the reimbursing bank the location of Reimbursement bank does not matter and the process is faster.

Beat competition and increase sales by providing higher credit period to your customer and still get paid at sight.

Avail matched currency financing for financing your exports and manage forex risk better.

Unlock your trapped cash in LC backed receivables and finance your working capital for business.

Reduce your cost of financing.

A bank guarantee is a promise by the bank to cover loss if their customer defaults on their promise to pay or perform as per contract. A bank guarantee can be of various types such as advance payment guarantee, performance guarantee, retention guarantee etc.

An advance payment guarantee is typically used when an importer has paid in advance for delivery of goods at a later date. This guarantee is used to protect an advance payment in case of failure by the exporter to deliver the goods as per contract.

A performance guarantee can be invoked by an importer in case an exporter of goods/services fails to meet the requirements of the contract for e.g. meet milestones.

In the scenario where the beneficiary is not satisfied with the bank that has issued the above mentioned guarantees they seek a counter-guarantee from a bank that they are comfortable with. The bank issuing the counter-guarantee is typically from the country of the beneficiary.

Allows importers of goods and/or services to work with high risk countries without worrying about advance payment / performance.

Forfaiting enables exporters to receive funding by assigning their trade-related receivables secured with trade finance instruments such as a Letter of Credit to a financial institution at a discount. Forfaiting enables the exporter to accelerate cash flow by selling their receivables on a non-recourse basis.

Accelerate your cash flows by discounting your receivables.

A Standby Letter of Credit (SBLC) is issued by a bank guaranteeing payment on behalf of the LC applicant (buyer) in case they fail to fulfil a contractual commitment with the LC beneficiary (seller). Buyers credit can be availed against an SBLC as the underlying security.

Avail for Imports under DA/DP where UPAS and RA structures cannot be used. Can be availed post shipment so no pre planning is needed.

No changes needed in the commercial contract nor does the exporter need to participate.

In the corporate space, we provide bank-neutral views, structured financial solutions and off-balance sheet solutions to clients for improving financial structure and efficient use of funds. Our endeavor is to provide a distinct bottom line advantage to our corporate/SME clients through a mix of traditional and non-traditional sources of funding.

In the financial institutions space, we provide services to banks and non-banking financial institutions in the area of risk mitigation techniques, Export Credit Agency business, trade finance origination & distribution and raising long term liabilities.

We actively use Interlinkages Online, our B2B cross-border trade platform, for better distribution, disintermediation and cost-effective delivery of financing solutions.

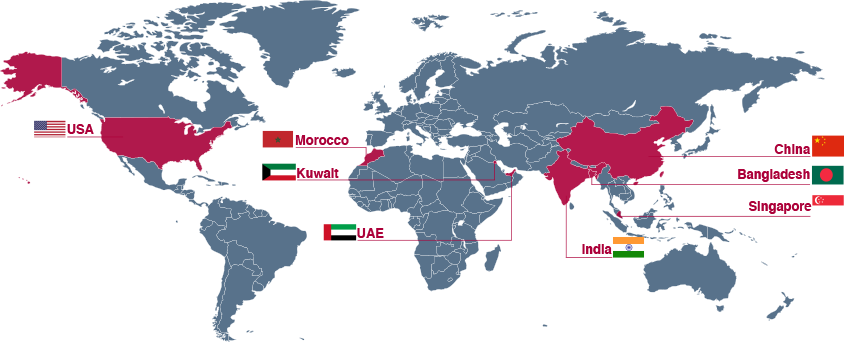

Global mandates delivered

We provide access to local and regional banks globally and help corporates and SMEs in diversifying their financial partners and adding new banks to their bank group.

We also provide trade finance solutions for working capital requirements and assistance in arranging foreign currency loans for long-term requirements.

Introduction to foreign country banks for the banking requirements of subsidiaries/JVs across the world.

Traditional working capital lines from banks – Letter of Credit, Trust Receipt, Bill Discounting etc.

Arranging External Commercial Borrowings, Project Finance or Foreign Currency Term Loans for long-term requirement.

Improving efficiency and better pricing by bringing new lenders.

Bank line business - Guarantee issuance, LC confirmations and discounting over longer tenor.

We provide end-to-end structured solutions for working capital or term financing.

On the working capital side, we arrange payables, receivables or inventory financing with non-recourse, part-recourse or recourse balance sheet structures. We also specialize in providing credit enhancements through private or sovereign insurance market to improve the credit rating of a debt instrument for better distribution and market appetite.

On the term side, we specialize in providing access to alternate liquidity providers like Developmental Financial Institutions, Export Credit Agencies and hedge funds. We can also assist in monetization of unfunded bank lines for arranging financing through different structures.

Structured working capital solutions – like back-to-back LC, front-to-back LC, etc.

Recourse / part-recourse / non-recourse receivable financing – with or without credit enhancements.

Export prepayment structures - pre-export unsecured advance against contracts/open accounts/LCs from the buyers. This significantly reduces the bank facility requirement of exporters.

Structured project financing through Export Credit Agencies and Developmental Financial Institutions - Direct credit limit on the projects can be arranged either with a single DFI or with a consortium of ECA/DFI's which makes the project significantly scalable.

We provide solutions for Trade risk distribution and Risk mitigation to Emerging Market banks leading to Capital relief and better returns. We also provide access to foreign currency low cost liabilities for emerging country banks.

Arrangement of Long-term liabilities from alternate sources for on-lending purposes to emerging country banks.

Capacity building for Trade finance from marketing perspective (for both Bank line & Open account) including introduction to global counterparties and support with documentation.

Capacity building for Trade finance including risk mitigation through Export Credit Agencies, Developmental Financial Institutions and Private Risk Insurance.

Providing access to low cost, long term (longer than available through bond markets), foreign currency, alternative liquidity.

Talk to our experts to find out how Interlinkages Online can help your business.

Talk to our experts to find out how Interlinkages Online can help your business.

Interlinkages Consultancy Limited

Unit 21, 5th Floor, Core, Cyberport 3

100 Cyberport Road, Hong Kong

© 2020 Copyright | Privacy Policy